Tech & E-Commerce

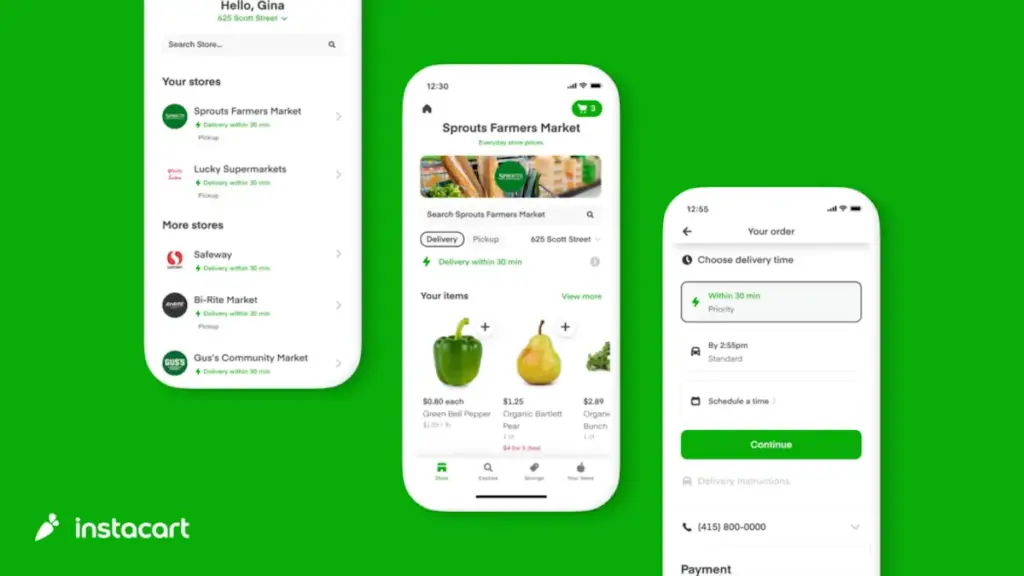

CEO Simo Predicts Growth for Instacart and the Online Grocery Sector

Instacart has achieved two consecutive quarters of double-digit growth and continues to expand its EBITDA, which Simo believes will enable the company to further capitalize on its future opportunities

Instacart is thriving in the competitive grocery delivery market, according to CEO and Chair Fidji Simo, who spoke at the Goldman Sachs Communacopia & Technology Conference on Tuesday. Simo emphasized that the delivery and tech company holds the largest share of the online grocery marketplace, with over 70% of the digital-first grocery segment. Instacart has achieved two consecutive quarters of double-digit growth and continues to expand its EBITDA, which Simo believes will enable the company to further capitalize on its future opportunities.

Simo pointed out that online grocery sales currently represent only 13% of the $1 trillion grocery market, a figure that lags behind other commerce categories. “As a category leader, our mission is to accelerate this growth,” she stated. This potential for expansion gives Simo confidence, even in the face of competition from players like DoorDash. She remarked that while some see the loss of exclusivity as a challenge, most of Instacart’s gross transaction volume (GTV) is already non-exclusive, yet the company continues to flourish.

The depth of Instacart’s integration with retailers is driving its growth in ways that competitors have not achieved. Simo noted that this may sound counterintuitive, but a deeper integration with retailers is a stronger predictor of success than exclusivity in the market. “While competitors may have attracted some retailers to their platforms, their integration remains shallow,” she explained. Retailers may list their inventory on competitive platforms, but they often lack deeper functionalities, such as integration with SNAP benefits and loyalty systems.

Courtesy of Instacart

This lack of integration has led to smaller basket sizes for competitors, who struggle to convert small-basket users into larger-basket customers. “To achieve this conversion requires massive scale, extensive user data, and solid retailer integration, which is why they have not cracked the code,” Simo said. Instacart’s real-time inventory data has become so sophisticated that retailers are now requesting insights into their own shelf inventories, as they often lack visibility into what is currently available.

Approximately 75% of Instacart’s GTV comes from stores that share planogram information, enabling the company to direct shoppers efficiently within stores to locate specific products. This level of integration allows Instacart to handle replacements for 80 million items each quarter, boasting a 95% satisfaction rate.

Instacart is also expanding its relationships with advertisers, aiming for ad sales to represent 4% to 5% of GTV. “Our path to achieving this involves enhancing advertising capabilities on Instacart and demonstrating to brands that we are the premier platform for their advertising investments,” Simo explained. The company aims to diversify its advertising partnerships, particularly with smaller brands that are experiencing rapid growth.

This week, Instacart announced a new partnership with Thrive Market, which will allow advertisers to run personalized, targeted ads on the platform. “We recently reported that we have 6,000 brands on our platform, which is a significant factor in Thrive’s decision to partner with us, as we can effectively support the growth of emerging brands,” she noted.

Instacart’s integration with loyalty programs has provided a competitive pricing advantage, resulting in an average savings of $4.75 per order for customers. “New entrants without over a decade of deep integration will inherently have higher prices, making it less appealing for customers to shop with them,” Simo stated.

Simo also highlighted the success of Instacart’s partnership with Uber Eats, which has introduced hundreds of thousands of restaurants to the app. She noted that this collaboration has exceeded expectations, driving faster adoption of restaurants among Instacart’s user base compared to how restaurant delivery platforms have integrated grocery offerings.

As Instacart went public on NASDAQ in September 2023, Simo reaffirmed that the company is still in its early stages, with the upcoming year being critical for its growth. Scaling operations with Caper Cart at grocers like Kroger and Schnuck Markets, as well as expanding deployments with other retailers, will define Instacart’s future and shape the landscape of grocery retail. “We’re also gaining traction internationally with Caper; our recent launch with Aldi in Austria is particularly exciting, as I believe it has the potential to redefine grocery retail,” she concluded.