Merge & Acquisition

Albertsons Executive: C&S Wholesale Grocers Prepared to Compete with Kroger, Albertsons

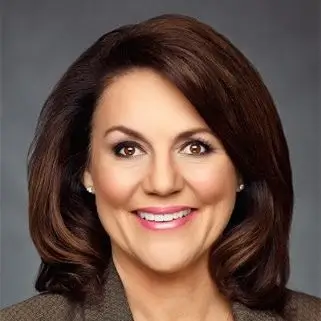

Susan Morris, Chief Operating Officer at Albertsons, initially felt disappointed when she learned that stores would need to be sold as part of the Kroger-Albertsons merger.

However, during the antitrust trial in Portland, Oregon, last week, Morris revealed that she has since embraced the idea and is confident that C&S Wholesale Grocers, the company acquiring 579 stores from Kroger and Albertsons, will be ready to compete. This shift in perspective was noted as Morris took the stand, according to a Bloomberg report.

In the trial, which is part of the Federal Trade Commission’s effort to block the merger, Morris admitted to having concerns when the divestiture plans were first announced in 2022. She had even sent an email to Albertsons’ executives expressing her reservations. Yet, Morris now believes the merger, and the divestitures that come with it, will boost competition in the grocery industry.

Albertsons made it clear in July that Morris would step into the role of President and CEO of C&S Wholesale Grocers, once the merger is finalized. With more than 38 years of experience in the grocery retail industry, Morris is confident in her ability to lead C&S as it acquires stores from the two grocery giants. She expressed enthusiasm about the opportunity, viewing it as a chance to build a business distinct from Kroger and Albertsons.

C&S will rebrand 286 stores over the next two years as part of the acquisition, a process that Morris is familiar with. She played a role in rebranding efforts during Albertsons’ acquisitions of American Stores in 1998 and Safeway in 2015. However, she clarified in court that she was not directly involved in those purchases. The Safeway deal, which saw more than 200 stores sold to Haggen, ultimately led to Haggen’s bankruptcy, but Morris remains optimistic about C&S’s future.

Morris assured the court that C&S has growth plans for the 579 stores it will acquire, signaling the company’s readiness to step up and compete with major players like Kroger and Albertsons.